Access your account on the go from your mobile phone, or your home or office 24 hours a day, 7 days a week. It’s convenient, safe and easy.

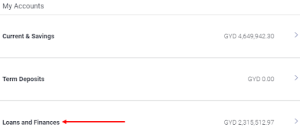

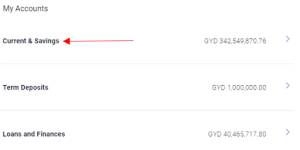

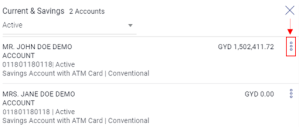

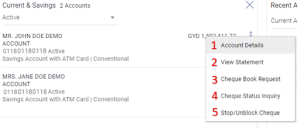

- Get real-time account statements

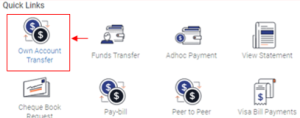

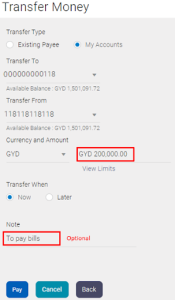

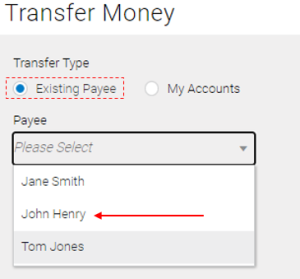

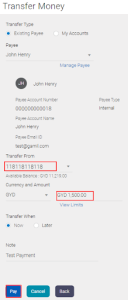

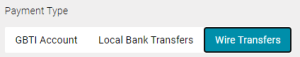

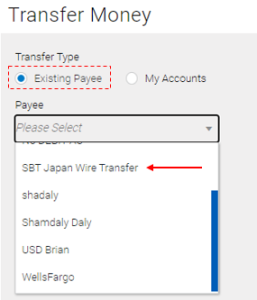

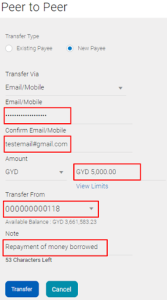

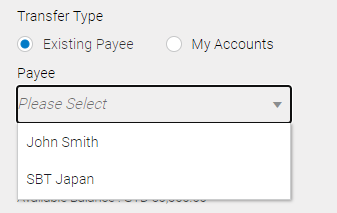

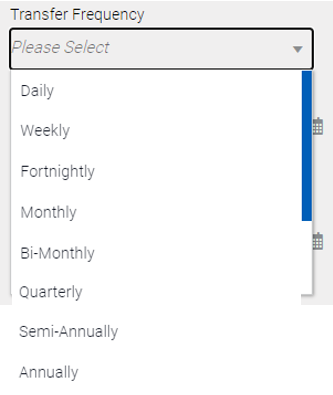

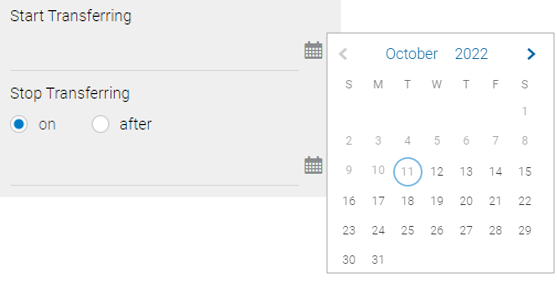

- Transfer funds between your own accounts

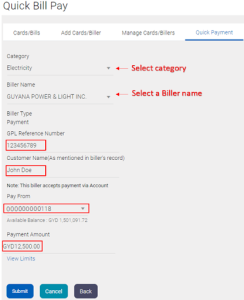

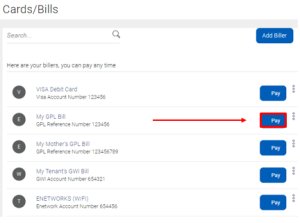

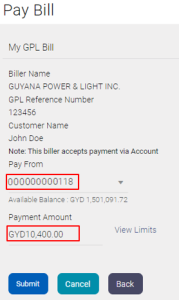

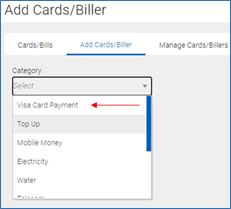

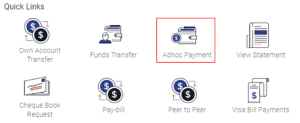

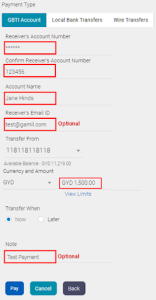

- Pay utility bills

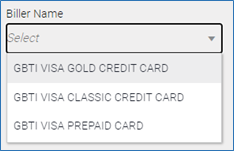

- Manage your credit cards and accounts

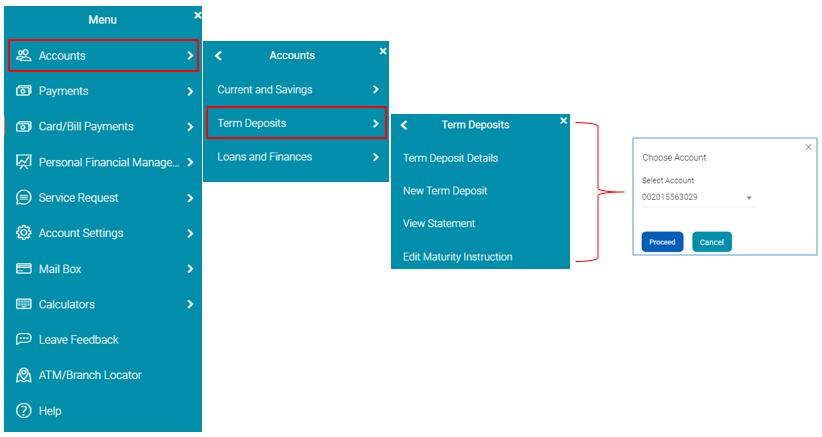

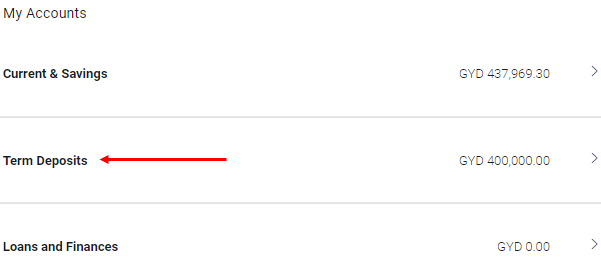

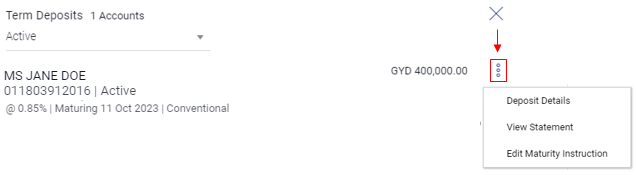

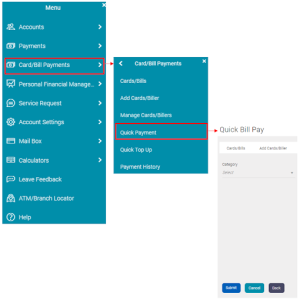

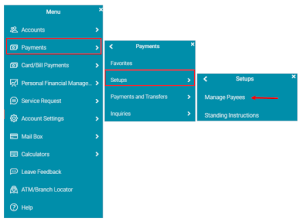

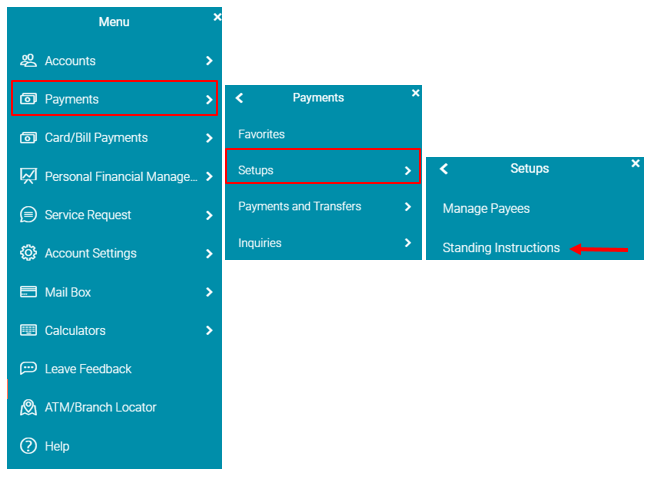

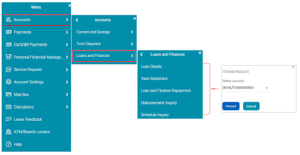

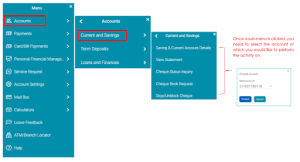

to view your main menu.

to view your main menu.

to view your menu.

to view your menu.