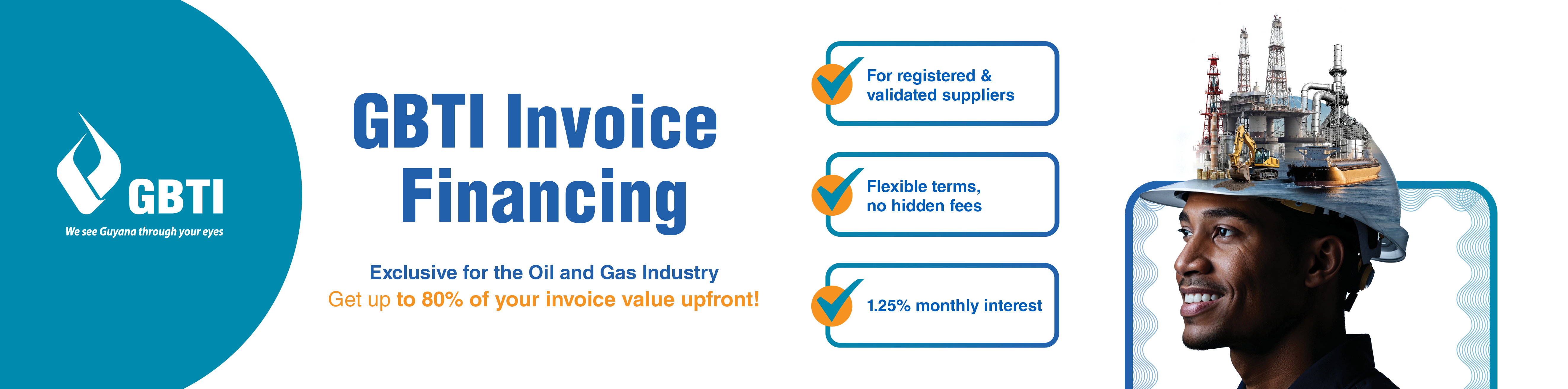

Invoice Financing

Strengthening Businesses. Powering Growth.

Strengthening Businesses. Powering Growth.

A short-term working capital solution where businesses can receive up to 80% of the value of their invoices immediately, instead of waiting for payment from contractors.

Visit any GBTI branch or contact our Business Banking Team at:

Chief Commercial Officer

D: 592 231 1072

M: 592 624 2618

M: 592 628 3569

Senior Manager – Corporate and Commercial Banking

D: 592 231 4400 Ext: 1478

M: 592 620 0630