Sign Up For GO Banking

What is GO Banking?

It’s designed for customers who need a fast and easy way to manage your account from home, work or on the go.

Do I need to have an Account?

Do I have to upload any new software on my PC or mobile device?

What is the cost to sign-up for GO Banking?

Is GO Banking Safe and Secure?

What does GO Banking offer?

- Check Account Balances

- View Account History

- Transfer funds between GBTI accounts

- Peer to Peer Transfers

- Make Bill/Utility Payments

- Requesting Bank Drafts/Account Statements

- Request Cheque Books

- Initiate and amend Term Deposit Instructions

GO Banking Sign In

*Please note you can only sign in if you are a current GBTI Online Customer.

- Enter your previous online banking User ID and Login password.

- You will be prompted to change your password. A link to reset your password will be sent to your email.

- Complete the form, accept the Terms and Conditions and then sign in.

Transactions available on GO Banking

- Check account balances

- View statements

- View Cheque images

- Pay utility bills

- Pay selected insurance payments

- Pay selected hire purchase payments

- Transfer funds between personal GBTI accounts

- Transfer funds to third party GBTI accounts

- Make Amendment to standing instructions on term deposits

- Request Manager’s Cheques

- Place Stop on cheques.

- General correspondence

Steps to pay your Visa bill online

VISA CARD PAYMENTS

You can pay your VISA card in one of two ways:

- Ad hoc Payments (Quick Payment)

- Pay through a Managed Biller

Ad hoc Payments

This allows you to quickly pay your VISA card in a one-off instant. Once you’ve paid on the card, the information is not stored for future retrieval i.e. you will have to re-enter the card information the next time you visit GO-Banking.

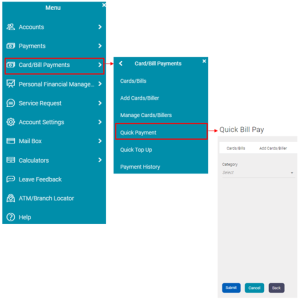

- Once logged into GO Banking, from the menu

- Select Card/Bill Payments then Quick payments

- Select VISA Card Payments from the dropdown.

- Under ‘Biller Name’ select the type of VISA Card Payment:

- GBTI VISA CLASSIC CREDIT CARD

- GBTI VISA GOLD CREDIT CARD or

- GBTI VISA PREPAID CARD

- Input your VISA Card details (Card Holder Name and Card Account Number)

- Select your Debit Account from which to pay

- Enter Payment Amount

- Submit and Confirm

Pay Through “Managed Biller”

This options allows you to store your VISA Card Payment details for easy payments in the future.

Once logged into GO Banking, select Visa Bill Payments from the Quick Links widget.

- Click Add Biller

- Select VISA Card Payments from the dropdown

- Under ‘Biller Name’ select the type of VISA Card Payment:

- GBTI VISA CLASSIC CREDIT CARD

- GBTI VISA GOLD CREDIT CARD or

- GBTI VISA PREPAID CARD

- Input your VISA Card details (Card Holder Name and Card Account Number)

- Click Submit to add Biller.

- Once the Biller is added successfully, revisit your Dashboard and click the Visa Bill Payments shortcut at your Quick Link widget. Locate the Biller and click Pay.

Mobile Banking FAQs

Do you need to have an Account?

How do I get the Mobile Service?

What kind of mobile devices are compatible with this service?

Is Mobile Banking Safe and Secure?

- Your APP is Password protected by a password known only to you.

- Your User Name and or password can be reset by you at any time

- You are automatically logged out of the APP, if you are inactive for 5 minutes or more

- An automated One Time Password (OTP) will be sent to your valid email or mobile number to complete certain transactions.

What does Mobile Banking Allow you to do?

View

- Account balances

- Transaction history

- e-Statements

Execute

- Transfers between personal, third party GBTI and other local bank accounts

- Peer To Peer Transfers using user Email or Facebook ID

- Wire Transfers

- Cardless Cash transactions such as Merchant Payments

- Real time credit card payments

- Loans Payments

- Bill/utility payments

- New Term Deposit

Initiate

- Service Requests for various Account Statements

- Goals to save towards

How to pay bills with GO banking and Mobile Banking?

Registering a Biller with GO Banking and Mobile Banking

(A payee could be MMG, a utility company, insurance, GRA or any other biller.)

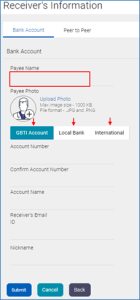

Select Bank Account to add a GBTI payee, a local bank OR an (International)

Wire Transfer Payee.

Select Peer to Peer to add a Payee that can be paid by simply inputting their email address.

Input your Payee Banking details and submit.

Funds Transfers to other GBTI Customers

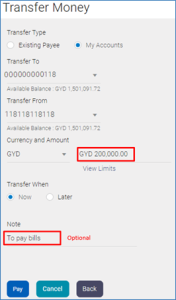

Own Account Transfers

Select ‘Own Account Transfer’ from your Quick Links widget.

Select your Debiting and Crediting account, input the amount, select transfer ‘NOW’ to send the transfer instantly OR ‘LATER’ to schedule the transfer.

Click Pay then confirm.

Internal (GBTI-GBTI) Transfers

Ad Hoc Transfer to GBTI Account Steps

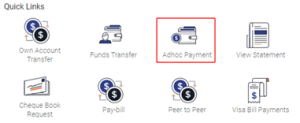

Select ‘ADHOC PAYMENT’ from your Quick Links widget.

Select the ‘GBTI ACCOUNT’

Input transfer details, select your debit account and enter transfer amount.

Click PAY then CONFIRM

Pay through MANAGED PAYEE Steps

By ‘Managing a Payee’, you are simply saving the GBTI transfer details to your profile for easy payments in the future.

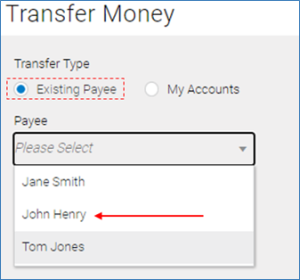

From your Dashboard click the FUNDS TRANSFERS shortcut at your Quick links widget.

Select, from your ‘Existing Payee’ list, the Payee you wish to transfer funds to.

Once your Payee is selected, input your transaction amount and click PAY

If you have several accounts, click the dropdown at the ‘Transfer From’ field to change your debit account.

What is Phishing?

GBTI caters to your banking needs wherever you are. From conventional Desktop to your Mobile App we make banking easy, safe and comfortable here.

GO Banking like never before!